Weekly Crop Commentary - 05/23/2025

May 23, 2025

Wes Bahan

Vice President, Grain Division

Good afternoon. It's hard to believe that we are ending yet another week. Planting progress, or lack thereof, seems to be the topic of discussion in our corner of the world. When the progress report came out on Monday, we found that 16% of the nation’s corn was planted last week. Ohio seems to be the only state behind pace, and several states to the west are all but done. It was also a big week for planting soybeans, and we are on schedule in the Buckeye State. Some 18% of the nation’s bean crop was planted last week. We need to see some activity next week, or there will start to be lots of conversations about corn acres that will become prevent plants.

Demand for corn continues to be strong, especially as the local market looks out and sees unplanted fields. Export sales for last week came in at just under 1.2 MMT. We have 15 weeks to go in the marketing year, and we have sold 96% of the USDA estimate. We are competitive with Brazilian corn, and the pace of shipments is confirming that demand is real. The crop progress update for this week won’t be out until Tuesday night due to the Memorial Holiday.

Haylee VanScoy

Director of Grain Purchasing

Grain markets appear to be squaring up ahead of the long holiday weekend, with added pressure from geopolitical tensions following President Trump’s recent announcement. He’s threatened to impose 25% tariffs on Apple products manufactured outside the U.S. and 50% tariffs on European Union goods starting June 1. Meanwhile, persistent rains continue to blanket much of the Midwest and are expected to soak the Mid-South and Delta regions this weekend. Cooler temperatures have also raised concerns, particularly in the northern U.S. growing areas, where low soil temps may delay or further impact crop emergence.

As we head into the final stretch of planting season, we’re hopeful for a clear window of opportunity in the coming weeks to help you make some solid progress. May is also Mental Health Awareness Month, and during a season like this—wet, frustrating, and wearing—it’s important to check in not just on yourself but also on your neighbors and friends. You are not alone, and there are resources available to support your well-being (see list below).

Lastly, a reminder that markets will be closed Monday in observance of Memorial Day and will reopen Monday evening. If you’d like to set grain offers while you’re busy in the field, don’t forget that you can enter them directly through the Heritage Portal. Contact your local merchandiser if you’d like access to this free and convenient tool.

Mental Health Resources

- Call or Text 988 for support

- AgriSafe Network

- Farm State of Mind

- OFBF Check Your Engine

- Got Your Back

- Better Help

- Mental Health First Aid

Briana Holtzman

Grain Merchandiser, Kenton (Region 1)

While it seems like we are seeing a break in the rain, temperatures remain on the cooler side, not helping things dry down. It looks like temperatures will stay cool until the end of May, and I am hopeful for some warmth going into June. Once into June, the markets will be highly focused on the Midwest weather forecasts. The United States total planting progress report from this week puts corn at 78% planted and soybeans at 66% planted.

The week began with some hope in the markets, as corn demand remains unusually strong for this time of the year. Wheat led the rebound, though, on reduced US crop ratings amid global production issues. Ending the week, though, markets are reacting to President Trump’s threat to the European Union for 50% tariffs and trying to limit risk going into the long weekend. Markets are closed on Monday for Memorial Day. Speaking of, I hope everyone has a great holiday weekend!

Steve Bricher

Grain Operation Manager, Urbana (Region 3)

It's Memorial Day weekend, but the weather is more like Easter. I saw a friend post yesterday that it was the 83rd day of March, and I cannot argue with him. I wrote in my comments a few weeks ago about how a dry spring will scare you, and a wet spring will kill you, sorry. We still have time, and if we get dried out because of the cool weather, the crop getting planted will not be that far behind what is already in the ground. For the most part, what is planted looks okay, but it is just growing slowly.

Corn and soybeans have had a good week when it comes to price. We have new corn over 4.00 and beans back above 10.00. The funds have reduced their short position as they don’t want to be short if the final 20 percent of this crop is not planted. We must continue to see how the crop moves forward and whether we see timely rains over the summer.

If you have been following the news out of DC on biofuels, you could get lost in the three-letter acronyms. Let me just say I get lost in the weeds. We are still awaiting an answer from the EPA and others about blending and usage. Once they decide, we will have a much better understanding of the demand for corn and soybeans.

Remember, the market will not wait for you to make a selling decision. Have a plan and implement it.

Zane Robison

Grain Merchandiser, Urbana (Region 3)

Happy Friday! Corn markets had a mixed session on Monday but rallied to end the week, including a streak of three consecutive green sessions. Much of this gain can be attributed to wet planting across the Midwest. While the crop progress report on Monday showed the nation is 5% above the 5-year average, several states are still far behind schedule, such as Ohio (14% behind the 5-year average). News of a large Brazilian crop has seemed to stall the markets at the time of writing this Friday morning.

Soybeans had a good week, considering they had to work against soy oil. Exports remain in line with the USDA projections.

The wheat rally seemed to end yesterday; it is still on track to beat export expectations.

I hope everyone has a great Memorial Day weekend!

Lisa Warne

Grain Merchandiser, Marysville (Region 4)

Happy Friday! The market started on a decent recovery this week but ran into roadblocks to end the week. All three commodities are 15+ cents higher than this time last week. On Wednesday, wheat reached a 50-cent improvement over its low set the week prior on 5/13. We were able to lock in $5.10 harvest price, a level we hadn’t seen in a month, for some customers in this area. If you have target prices in mind for your wheat, give us an offer to watch for you.

Crop progress for most of the U.S. is excellent. For corn, with 78% planted (73% average), all states except Ohio and Kentucky are near or ahead of their average. Ohio is sitting at a very disappointing 34% (48% avg). Soybean progress is at 66% nationally (53% avg), with Ohio at 40%, one point ahead of average. With the nation getting a majority of the crop planted in a timely manner, eyes will be on weather and crop conditions to hope for any rallies ahead.

To close, I would like to express my appreciation for those servicemen and women who have given their lives for our benefit. Their sacrifice does not go unnoticed as we celebrate their holiday this weekend. Happy Memorial Day!

Ralph Wince

Grain Merchandiser, Canfield (Region 5)

Good afternoon; the grain markets continue to get caught up in the crosshairs of the ongoing tariff war. This morning President Trump posted on social media that the European Union was formed primarily for taking advantage of the United States in trade. He recommends that the United States implement a 50% tariff on June 1st. That also sent the VIX fear index up to 25 this morning.

With the 3-day weekend coming and the news I just wrote about, we are seeing traders taking some protection here today. Corn is down -06 cents, beans are down -11 cents, and wheat is down -05 cents, as I write this. As we get ready to turn the calendar to June, we will start to see more focus on what weather forecasts look like. But today the markets are not overly concerned about that. One point I will add today is that the Funds are at or near having a short position in corn & beans. If a story starts to develop, it won’t take long for them to jump back into his market.

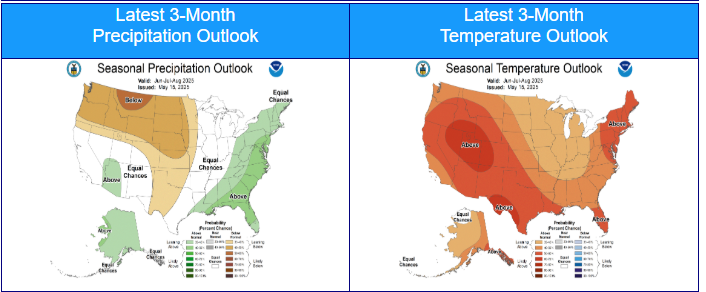

As far as planting progress here in the NE part of the state goes, it depends on where you are. Some areas made good planting progress, and others had harder-to-find dry fields. I would put planting progress in NE Ohio at corn 60-65% done, and beans around 50-55% done. Below is the latest version of NOAA’s June, July, & August weather forecast. It still appears that the Midwest areas could be drier and warmer than usual. We will continue to monitor this in the weeks ahead.

Finally, I want to take a second to remind everyone as we celebrate Memorial Day on Monday that the freedoms we so much enjoy in this country are essential to all of those who gave their lives for what we have. Please be sure to take time to remember them and their families this weekend. Happy Memorial Day to all of you out there.

Morgan Hefner

Grain Merchandiser, Nashport (Region 5)

Happy Friday! Ohio was still behind on corn planted at the beginning of the week sitting at 34% planted, compared to the 48% five-year average. Although corn seems behind, soybean progress shows it is right on track. A few days early in the week allowed for more planting, but the progress still seems a little hit-or-miss across the state. We must wait and see how much may get planted this weekend.

At the beginning of the week, we saw a slight increase in the corn, soybeans, and wheat markets. Unfortunately, that did not hold true through the week. There seems to be some uncertainty in the market at the end of the week, possibly due to more tariff talk from the President with the EU.

Have a great Memorial Day Weekend!